Returns Solutions –

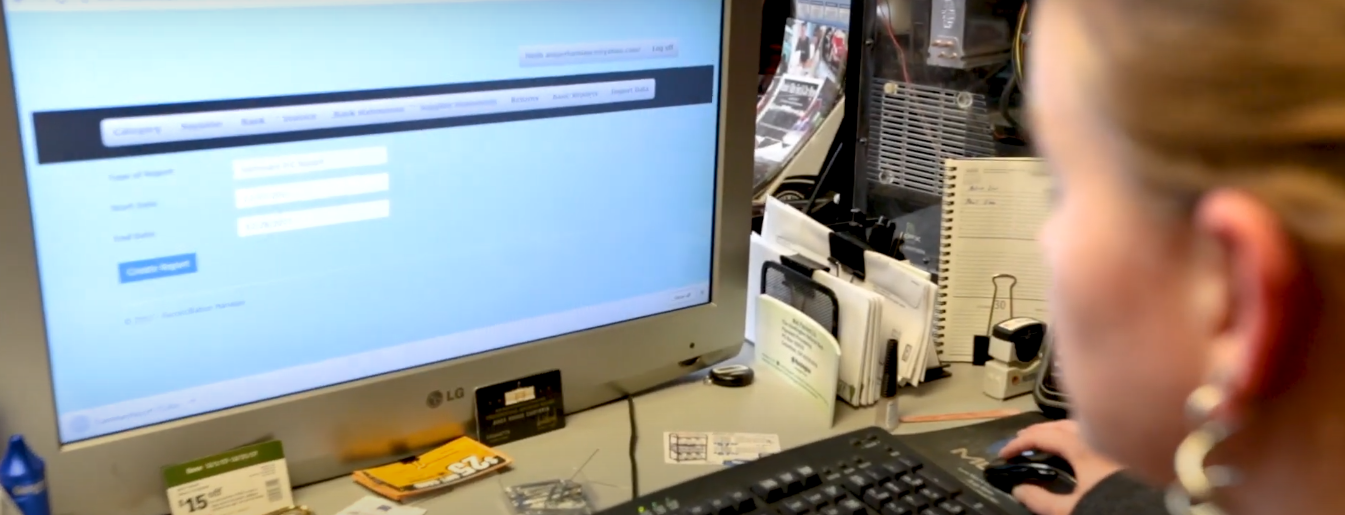

ReturnsSolutions automates your accounting, reconciles statements, and turns cores into cash so you can focus on running your business.

Get every credit

Never miss a return or core charge

Save time

Complete bookkeeping in minutes, not hours

Boost profits

Identify tax deductions and eliminate hidden costs

Stress-free audits:

IRS-ready reports at the click of a button

Start Saving Today

- Service Advisor Module

- Empower your front-desk and boost your repair shop profitability

- As part of the Returns Solutions family, our Service Advisor software gives your shop the tools to professionally write jobs, track customers & vehicles, streamline approvals and get paid faster — all in one place alongside your accounting solution.

- Stop juggling spreadsheets and separate systems. One login. One database. Two powerful modules: Accounting + Service Advisor.

Benefits (What’s in it for the Shop)

- Faster Turnaround – By giving your service advisors streamlined tools, you reduce time from vehicle check-in to job assignment to invoicing.

- Higher Repair Order Value – With access to vehicle history, digital inspections, and upsell prompts, you capture more of the recommended work.

- Better Customer Experience – Transparent inspections, timely updates, and professional estimates increase trust and repeat business.

- Reduced Errors & Lost Revenue – With seamless integration between service writing and your accounting module, you avoid duplicated data, missing invoices, or mis-booked jobs.

- Actionable Insights – See what your advisors and techs are doing, where the bottlenecks are, so you can continuously improve.

- Scalable Growth – As you add locations or advisers, the system grows with you. Using a single platform rather than multiple helps you scale more easily.

How It Works (3-Step Process)

- Check-In & Write Up – Service advisor checks in the vehicle, records customer/vehicle data (or selects existing customer), captures initial inspection.

- Create Estimate/Work Order – Add parts, labor, apply markup, show margin warnings, present digital inspection with photos/videos to customer for approval.

- Approve & Invoice – Once approved, convert the estimate to a work order/invoice, update parts inventory (optional), process payment, and sync with the accounting module so your books stay current.

Why Choose Returns Solutions’ Service Advisor Module

- Backed by over 30 years of automotive business and shop accounting experience (you, as the owner, bring real-world shop floor and accounting knowledge).

- Designed specifically for automotive repair shops — not a generic office program shoe-horned into shop workflows.

- One platform, two modules: Accounting and Service Advisor — you don’t have to stitch disparate systems together.

- Focus on your primary roles: You, the experienced auto shop owner serving other shop owners, understand the pain points — we built for them.

- Ongoing support, updates, and training — so your team gets up and running fast and stays current.

Call to Action

Ready to streamline your front-desk and boost your repair shop’s profitability?

Request a Demo | Start Your Free Trial

(or)

to schedule a custom walkthrough.

Combine the power of our Service Advisor Module with our Accounting Module — all from Returns Solutions.

Testimonials

Final Call‐to‐Action

Ready to Stop Overpaying & Start Saving?

- Instant Access: Cloud-based no installation required

- User-Friendly: Your team can use it in minutes

- Start Seeing Value: Watch your savings mount from day one

- Log in for the Free Demo https://dublinmotors.azurewebsites.net/

- Buy Now – Start Saving

Manual Tracking vs. ReturnsSolutions

Feature

- Core & Return Tracking

- Time to Reconcile Statements

- Risk of Human Error

- IRS Audit Preparation

- Expense & Deduction Tracking

- Break-Even Analysis

- Training Required

- Monthly Loss Prevention

- Cost of Errors Over Time

Manual Methods (Spreadsheets)

- Often missed, relies on memory and guesswork

- 5–10 hours monthly, often delayed

- High — one wrong cell can cost you hundreds

- Disorganized, stressful, and reactive

- Manual categorization — often incomplete

- Requires custom formulas or doesn’t exist

- Complex and inconsistent — not everyone understands Excel

- Unknown — losses are discovered too late

- Adds up fast — lost returns, misfiled invoices, overpaid taxes

ReturnsSolutions

- Auto-tracked with alerts — never miss a return

- Reconcile in minutes — drag, drop, done

- Built-in safeguards catch costly mistakes

- Audit-ready reports — clean and compliant

- Automated and categorized — maximize write-offs

- Built-in dashboard shows daily profitability

- Designed for shop owners — easy, intuitive interface

- Real-time alerts stop losses before they happen

- Pays for itself in savings — often in the first month

Bottom Line

Manual tracking costs time and money. ReturnsSolutions gives you both back with accuracy, speed, and peace of mind.